Last night I spent about four hours putting together my tax forms for 2010. I use the Deluxe version of H&R Block at Home (which, by the way, I downloaded this year instead of buying the disc – no complaints from me about the downloading process). And even after using H&R Block’s software, spending those four hours pouring over different tax forms, and giving my taxes an incredible number of reviews it appears that 2010 is the first year since I’ve been filing returns where I’m actually going to have to make a tax payment. Well, I’ll have to make two payments – one to the State of New Jersey and one to the Internal Revenue Service.

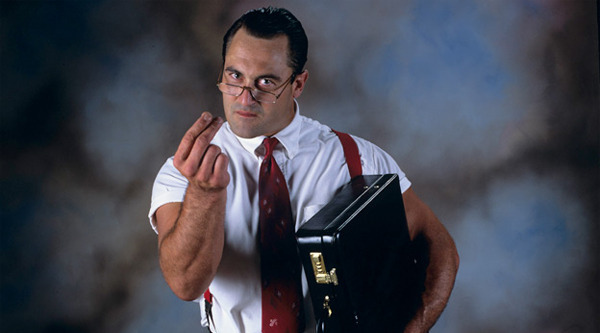

Alright, so WWE alumnus Irwin R. Schyster isn't actually getting my money, but you get the point!

According to the tax software, I owe the great State of New Jersey $525 while I owe the IRS some $3,686. In total, I owe $4,211 in additional taxes for last year. Sure, I have a few more reviews to make on the various tax forms (my taxes are really complicated – see the next paragraph), but I don’t think that these numbers are changing too much.

The reason why my taxes are increasingly complicated is because of all of the stuff that I “do.” In fact, if you’ve been reading this blog for a while then you know that I bitch every once in a while about being too busy. Well, that hectic schedule carries over a similar craziness when it comes time to do my taxes. You see, I get some W-2 forms (my day job and teaching at the local college), a bunch of 1099-MISC forms (teaching at the online college, a few for certain types of income earned from Usable Web Solutions, etc), a 1098-T form for the classes that I was able to take for free last year at the local college, two different student loan interest deduction forms (one from the USDOE and one from NJHESAA), a Schedule C for my website company, a Schedule C for the other small business that I started for the online teaching and grant writing, a 1099-B for proceeds from stock sales, etc, etc. It gets ridiculous after a while.

If I didn’t have such a good handle on all of this stuff (I think), then I’d seriously consider getting myself an accountant to do this work for me. But I think I have a good grasp on what’s going on with my funds, so I’m confident in this return. But to get back to the point…

I already pay my taxes. Just like the rest of the working world, my company deducts my tax obligation through my paycheck and – just like the rest of the working world – I get sick at how much money gets taken out of my paycheck for taxes each pay period. However, I’m fine with paying an additional $4,211 in taxes for last year. Why? It’s simple, really.

I made a good amount of money last year.

Look, folks – I’m not writing this entry to brag or toot my own horn or anything because I’m not bringing in the big bucks by any means. However, think about what you’ve read on this blog for the last year or two: I work at a day job, I’m an Adjunct Professor at the local college, I’m an online instructor at a very well-known online college, I’ve owned a successful and profitable small business for 5 years, and I contract for some low-level consulting and grant writing jobs for local nonprofit organizations. I work like a madman! And, obviously, one of the end results of that type of work schedule should be an increase in a guy’s annual income and, thankfully, that’s how it worked out for me last year.

I WANT To Pay These Taxes

But the reason why I wanted to share the fact that I’m paying a lot of taxes for last year’s income is because I want to pay these taxes. That’s right – I want this additional tax liability which is over and above the taxes that I already paid last year. Why do I want this increased liability? Because when you pay more in taxes, it means that you’re making more money and everyone should want to increase their annual income. Of course, most folks won’t have a convoluted tax return like I have where certain revenue streams deduct federal income taxes and others don’t, but just remember the lesson here: the more money you make, the more money you’re going to owe.

It’s okay to owe a few tax dollars at the end of the year – it means that your income is going in the right direction. Good luck on your tax returns this year, everyone!