In a bit of a reprieve, I checked my online account with NJHESAA today and they finally posted the payment that I dropped in the mail ten days ago. For the life of me, I’ll never know why they don’t post these payments quicker (though I really think that it has to do with them holding back on payments so they can collect more interest). However, I’m glad that I didn’t have to engage in that nightmare scenario that I contemplated in my entry a little bit earlier. Score one for the good guys!

What Are We Waiting On Here, NJHESAA?

I’m not going to waste my time retyping something that I posted on this blog a few months back, so allow me to copy and paste something I wrote a few months ago. The topic of this post is how I sent a check to those nonchalant student loan payment processors at the New Jersey Higher Education Student Assistance Authority (NJHESAA) LAST MONDAY (TEN DAYS AGO) and it has YET to be applied to my balance as per my online account statement.

From back in February 2010:

Well, another issue that I’ve been aggravated about with NJHESAA is their inability to process my paper check payment in a timely fashion. For example, after I send a student loan payment to this private lender it generally takes them 10 – 15 days to process the check. WHY!?!?!

Why does it take NJHESAA so long to process a payment!?

Well, if you know anything about finance and how loans work, then you know why it takes NJHESAA so long to process payments. It’s very simple – the longer you hold a payment and not process it, the more the interest due on the payment grows. Here’s my real world example:

On Thursday, February 11th I sent my latest payment to NJHESAA. As of that date, I owed about $62 in accrued interest. Now, I understand that it takes some time for my payment to work its way through the postal system, through the NJHESAA’s mailing system, and eventually to be deposited in the bank. In 2010, that process should take between 3 and 5 days.

However, since my check has not been deposited yet and here we are – 9 days after the payment was sent – another $85 in interest has been accrued. So the total interest owed on the NJHESAA loan today has gone from $62 on the day that I sent the payment to $147 today. How disgusting is that?

And I don’t believe for one minute that my payment isn’t sitting on someone’s desk at the NJHESAA waiting to be deposited early next week. After all, since NJHESAA is closed on the weekends they get to accrue a few more days of interest by not depositing my check! Awesome! And why do I not believe that the payment isn’t sitting there? Because I have a job and I know that when someone sends me something, I get it in a matter of 2 or 3 days. There isn’t any big secret to the United States Postal Service – you send an item and they deliver it. In the rarest of cases your item might be lost, but the chances of that happening are slim to none.

What bothers me as of when I’m writing this entry (which is the night before it is scheduled to be posted on the blog) is that my check has been both cashed by NJHESAA (as of last Friday) and cleared by my bank (as of this past Monday). Meanwhile, my online account was not updated last Friday, over the weekend, this past Monday, or on Tuesday. What the hell is NJHESAA waiting for?! They have my check deposited in their greedy coffers already – post the damn payment!

I think we know which direction this is headed in… I’m going to wake up today (remember, I’m writing this the night before), the payment won’t be posted to my account, I’ll wind up calling NJHESAA, they’ll treat me like I don’t know anything about student loans or how to repay a loan (HA!), I’ll get frustrated with their insolence, they’ll get frustrated with my insolence, they’ll tell me the payment is lost, I’ll tell them they cashed it and I demand it be posted, they’ll tell me that they need proof of it being cashed, I’ll tell them that THEY CASHED IT and that they have the proof, and we’ll stalemate.

What a wonderful morning to look forward to… I need to get away from NJHESAA and FAST. They are, by far, the worst consumer debt organization that I’ve ever dealt with, EVER! I’ve dealt with every major credit card company, all of the major phone companies, and the major cable companies and always been able to come to some resolution on the phone. The NJHESAA? Ha ha ha!!!

Well, let’s hope that my anger is unfounded and that my already-processed payment is posted to my account when I wake up in the morning.

Two More Weeks, Two Thousand More in the History Books

The headline of this topic is pretty deceptive. No, I didn’t go from $77 thousand owed during my last update to $75 thousand owed during this update. In total, I only dropped down to $76 thousand owed on my student loans (still not bad!). However, the breakout of my student loan debt has shifted just a little bit so that I owe two thousand less on my New Jersey Higher Education Student Assistance Authority (NJHESAA) loan than I did about two weeks ago.

Another Thousand Down

Not bad, huh?

At this point, I owe about $21 thousand on my NJHESAA student loan and about $54 thousand on my United States Department of Education (USDOE) loan. Some of you might do some quick math and say that 21 plus 54 is actually 75 so my numbers must be off. Not quite. As it turns out, when I report how much money I owe on each of these loans, I just report the quick numbers in order to make it easier to comprehend. So, in reality, I owe about $21,800 on my NJHESAA loan and about $54,678 on my USDOE loan.

See how that could make a difference when I say that I have $76 thousand worth of student loan debt left versus $75 thousand?

Anyway, I’m not worried about it. Now that I (finally) have some additional teaching income on its way in I’ll be able to fix this anomaly without any major problems in my expected free cash flow. Hey – I meant to ask this a few student loan entries ago, but is there anyone else out there paying back student loans? If so, I’d love to hear from you via a comment on this blog if you have the time. I always like hearing people’s stories!

Oh – and before I forget to mention it – this latest payment puts me at a place where I’m really close to cutting the NJHESAA loan in half during the past year. Stay tuned around the beginning of October for that announcement… 🙂

In May 2006, I graduated from Rutgers University with a Masters Degree and $120,720 in student loan debt. I currently owe $76 thousand, which breaks down to $21 thousand owed to the New Jersey Higher Education Student Assistance Authority and $54.6 thousand owed to the United States Department of Education. Follow my student loan repayment story on JerseySmarts.com.

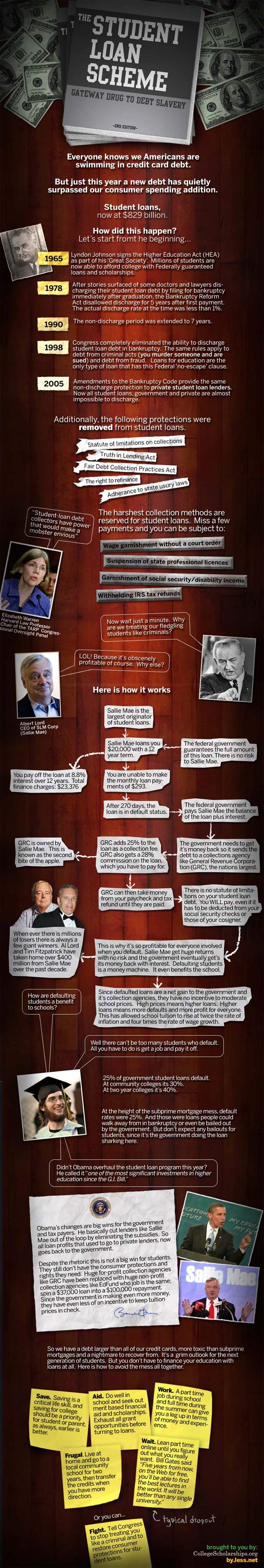

Some “Graphic” Commentary on the Student Loan Industry and the Government

While I was browsing around the internet the other day, I saw the graphic that you can see below. The reason that I am posting this on JerseySmarts.com is because I found that while I was reading the information on the graphic, I was smiling and enjoying the fact that someone went through all of the trouble to put this stuff together in an attractive format. Plus, I’m a big advocate for student loan repayment so I thought I’d share this with you folks since it talks about what happens when someone, unfortunately, doesn’t repay their loans.

Enjoy!

Another Thousand Down, But From A Different Source…

Well, well, well… I have a bit of a surprise to report in the latest update to my student loan repayment story. Actually, this isn’t really a surprise any more than it is an obvious eventuality of my repayment system, but it’s certainly a change from the previous updates that I put up here on the blog.

Down to $77 thousand!

And that’s where the obvious eventuality comes from that I referred to earlier. This was obviously going to happen at some point since I have an automatic payment setup with the USDOE to pay the monthly amount due on their loan. And this comes at a good time, too, since my most recent payment to the NJHESAA was less than $1,000 and thus I might not have had one of these fancy reports to post on JerseySmarts.com for you, my good readers!

I just checked my NJHESAA repayment projections and it seems like there might be a nice surprise in store for my repayment plans around early to mid-October. There’s a strong chance that I might be reporting a double drop either around the first or fifteen of October (if not beforehand). So let’s hope that the repayment projections stay their course, huh?!

In May 2006, I graduated from Rutgers University with a Masters Degree and $120,720 in student loan debt. I currently owe $77 thousand, which breaks down to $23 thousand owed to the New Jersey Higher Education Student Assistance Authority and $54 thousand owed to the United States Department of Education. Follow my student loan repayment story on JerseySmarts.com.

- « Previous Page

- 1

- …

- 14

- 15

- 16

- 17

- 18

- …

- 29

- Next Page »