Hey everyone – just a quick update today on my student loan repayment progress. Can you believe that it has been three months since my last student loan update? Good grief! Sure, we had the interaction with USA Today in between, but the truth is that my student loan debt drops haven’t been coming as quickly as I had originally intended.

Sitting at $50 thousand

You know, once upon a time I had envisioned being done with all of this student loan garbage by the time that I turned 30 years old. Well, that didn’t quite happen! However, I think that I can come really close to blasting out the rest of this debt by the time I reach 32 – and that’s pretty good when you consider all of the various factors involved in repaying student loans.

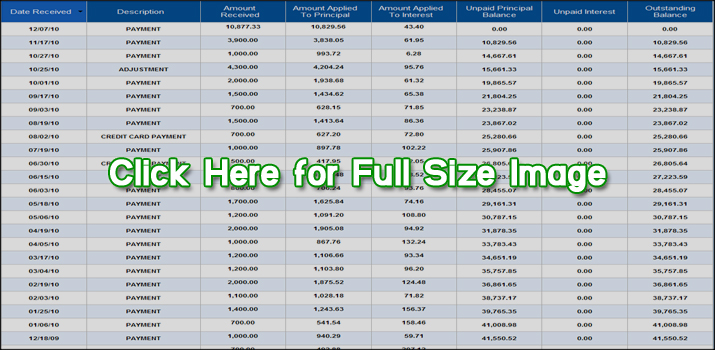

But the reason for ultimately posting this entry is to announce that my student loan debt has dropped once again. This time, I’ve gone from $51 thousand down to $50 thousand and I’m sitting on the precipice of something great. According to my repayment plan, after my next payment (later this month) I should finally break through that barrier. After that, hopefully I’ll be able to really ramp up the repayments and send this debt downhill quick.

Could I reach $40,000 by the end of 2011? If so, then I would be strikingly close to the same position I was in at the beginning of 2010 – when I decided that 2010 was going to be the year that I eliminated the NJHESAA debt. Better yet, could I be down as low as $35,000 by the end of 2011? I guess you’re all going to have to stay tuned and find out!

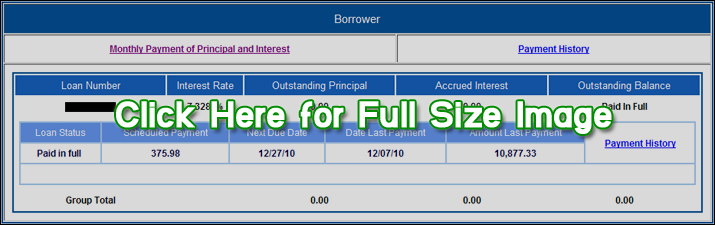

In May 2006, I graduated from Rutgers University with a Masters Degree and $120,720 in student loan debt. After completely repaying over $61 thousand in student loans from the federal Perkins loan program, the New Jersey Higher Education Student Assistance Authority, and CitiBank, I currently owe $50 thousand to the United States Department of Education’s Direct Loans program. Follow my student loan repayment story on JerseySmarts.com.