It seems like it was just yesterday (or seven years and three months ago) that I announced I paid off my student loans… for the first time. Back then, I was happy to announce that I paid off my undergraduate and graduate student loans over a repayment journey that lasted seven years and one month. That journey covered a total repayment of $149,455.12. But it wasn’t just $149,455.12 repaid and then everyone goes home happy. No. I repaid that amount during the beginning of my career when my income was also at its beginning and without any financial assistance coming in for any living expenses or any other costs. In fact, USA Today covered my story in an above-the-fold cover story in their newspaper. During that repayment, I learned that if you focus, work hard, and do not waste your income on frivolous garbage, then you can redirect a substantial amount of that income towards paying down debt and actually be successful in paying it off. So that’s just what I did to repay my first student loans off in August 2013.

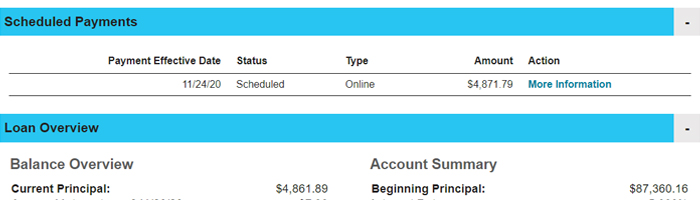

A screenshot of my last student loan payment, which went out this morning

Then two years later in August 2015, I started on a new academic journey to earn a doctorate. That quest ended in May 2018 when I earned my doctorate from the University of Southern California at a grand total cost of $89,286.86. I also financed my doctoral program through student loan debt. Repayment on those student loans began in December 2018 and now, just about two years later, I am happy to announce that I have fully repaid the doctoral student loans as of this morning. When I have a screenshot available of that student loan balance coming in at $0, then I will share it here for everyone to see.

The final count for the doctoral student loans is as follows:

$87,360.16 in loan principal

$1,878.84 in capitalized interest

$47.86 in closing and refinancing fees

$6,084.93 in interest

Total Amount Repaid: $95,371.79

When you add up the undergraduate, graduate, and doctoral student loans, the total amount I repaid is $244,826.91. I never missed a payment, never incurred a late fee, and never asked for a deferment for any reason. I took out this debt knowing that it meant I would have to repay the obligations I was incurring. I never asked for my loans to be forgiven. I never contemplated a world where I would want them to be forgiven. I never believed that other people should be forced to pay for my student loans. The discipline needed to pay off these loans gave me a near perfect credit score.

While I am thankful that my student loan repayment journey is at an end (for good, this time), I am even more thankful of the financial discipline and education that I was able to garner over the last 14 years. Stay tuned to my blog for more student loan entries in the future… they just will not be covering my own student loan repayment because it’s finally over!

I repaid $244,826.91 in undergraduate, master’s, and doctoral student loans. The debt was comprised of $193,430.16 in loan principal, $14,313.42 in capitalized interest, $2,146.59 in closing and refinancing fees, and $34,936.74 in interest. My lenders included the United States Department of Education’s (USED) Perkins loan program, their subsidized and unsubsidized Direct Loan programs, the New Jersey Higher Education Student Assistance Authority’s NJCLASS program, CitiBank, and SoFi. You can read my entire student loan repayment story on JerseySmarts.com.

Leave a Reply